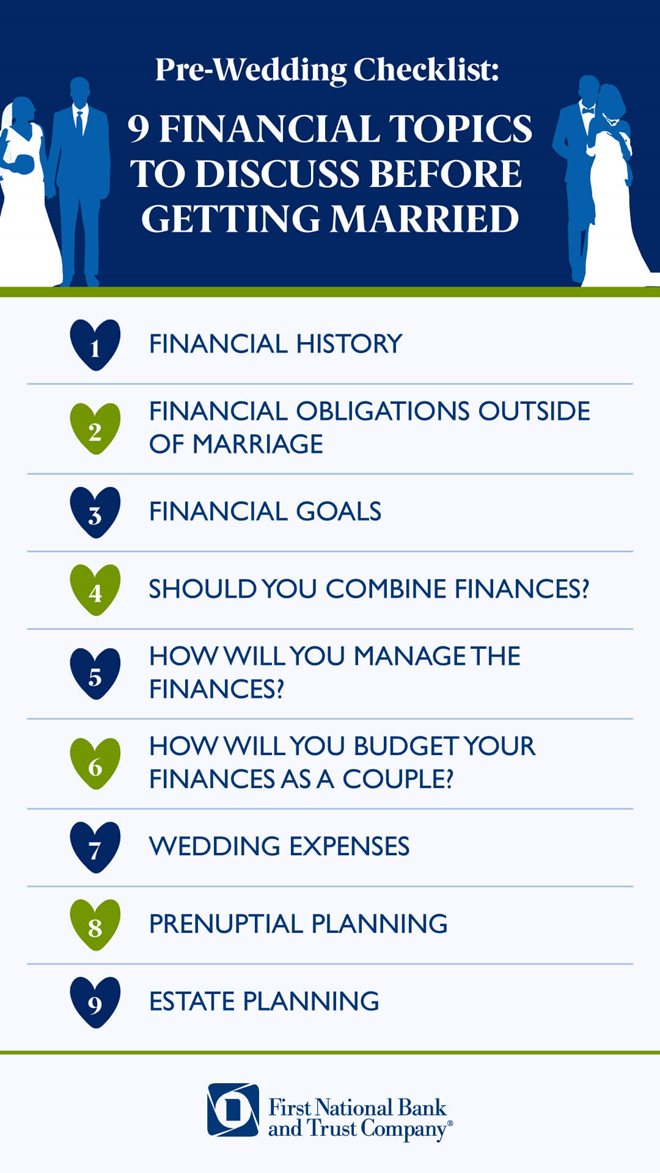

Pre-Wedding Checklist: 9 Financial Topics to Discuss with Your Fiancée

It's important to understand your personal and joint finances when you're starting a life together. Here are 9 things to discuss before your wedding day.

Congratulations on your recent engagement! While discussing honeymoon ideas with your fiancée and searching for the perfect place to exchange your wedding vows, you may want to stop and discuss another important detail with your future spouse – your finances. Talking about finances can be a serious or uncomfortable discussion, but it is necessary. It’s important to get on the same page about finances when splitting household bills and working toward long-term goals together. While money can be a source of conflict in marriage, it doesn’t have to be. Here are the nine money matters to discuss before marriage.

Understand each other’s Financial History and Upbringing.

Money can be a source of pain and shame for some people, so resolve to be gentle with each other and have this conversation at your favorite coffee shop. Taking turns, talk about:

- Your personal financial history

- What your parents taught you about money (explicitly or implicitly)

- The feelings and beliefs you have about money now

- Your monthly take-home income

- Current checking, savings, and investment or retirement account balances

- List of debts such as a car loan, student loan, or credit card balance

- How you like to handle money and your spending habits

Your partner’s attitude towards money (and spending/savings habits) can affect your ability to achieve financial goals (and vice versa), so it’s important to understand each other’s money mindsets and try to get on the same page.

Financial Obligations Outside of Marriage

Depending on your age and life situation, you may be coming into your new relationship and marriage with a child(ren) from a previous relationship or ownership stake in a business. Those additional responsibilities may come with financial obligations, such as child support payments, that need to be disclosed to your partner and accounted for in your joint budget.

It’s also a good idea to discuss any family members who may need financial assistance now or in the future. How will you handle a family member’s request for money?

Talk about Financial Goals

Talk about your individual goals, such as paying off student loans or other debt, as well as your shared goals for the future, such as buying a house, saving for a wedding and honeymoon, and more.

Once you’ve identified all your goals, create a timeline for when you can realistically expect to reach them. For example, how much can you set aside each month to throw at your debts and deposit in savings?

To Combine or Not to Combine Your Finances

This is the question. Whether to keep some or all accounts separate or go joint with everything is one of the most important financial decisions you can make as a couple.

On one hand, maintaining joint finances in marriage can streamline things and make it easier to budget. But a

joint checking account can also lead to conflict if both partners aren’t on the same page about how to spend money or if one person makes significantly more than the other.

On the other hand, separate checking and

savings accounts give each spouse a certain measure of privacy. You can spend on whatever you want (within your budget) without feeling judged for your purchases. Many couples that want to keep separate accounts still have a joint account to pay household bills. However, the more your finances are separated, the more risk there is of “the right hand not knowing what the left is doing” when it comes to spending and saving, which could cause its own set of problems.

Ultimately, this decision is individual to each couple. You may have a joint checking account with separate credit cards, a joint savings account for household goals, as well as separate accounts, or any combination that makes sense to you. It doesn’t matter what your friends are doing; the important thing is what works for you.

Who Will Manage the Finances?

This is another personal decision regarding money and marriage for every couple to make based on their individual strengths and preferences. Typically, the choice is between one person managing the family’s finances or both partners budgeting together. Your set-up may also depend on whether you decide to combine finances or maintain some separation. Looking for a new checking account? Check out these

tips for choosing a checking account.

How Will You Budget Your Joint Finances?

A budget is simply a roadmap for your financial present and future. When budgeting with a partner, the process should help you set priorities, make compromises, and align your spending with your values. Factors to think through include:

- What are your priorities?

- Do you have debt to pay off, such as a credit card balance or student loan?

- Are you saving up to buy a house?

- What are your other savings goals, such as building an emergency fund and contributing to your retirement fund?

- How much of your budget needs to be allocated towards monthly bills and expenses like groceries?

- How much will you leave for discretionary spending, “fun money”?

When

creating a budget together, you should also talk about how you will adjust your spending and savings habits as a couple.

The Wedding Expenses

The average cost of a wedding is $26,000 in Wisconsin and $37,000 in Illinois,

according to recent data from The Knot. So, if you are planning a wedding in the near future, the big question is how it will be paid for. Can one or both of the families help out with wedding expenses? If you have to pay for it yourself, you’ll need to create a budget for your big day and save toward that total. While it’s best to avoid taking on debt to pay for your wedding if possible, a

personal loan can be an affordable and convenient way to cover the costs of a wedding.

Another thing to consider is what you want to do with the money you receive as wedding gifts. Will you use it to cover wedding expenses, pay for your honeymoon, save for a house, or something else?

Prepare for The Worst While Hoping for the Best

When preparing for marriage and finances, some couples talk with a lawyer to draft a prenuptial agreement. This document determines who is responsible for which debts and gets which assets in the event the marriage is dissolved. Prenuptial agreements are often sought when one partner has significantly more wealth or debt than the other.

FNBT cannot recommend whether or not a prenuptial is right for your situation. To determine whether or not this is right for you, consult with a local family law attorney:

Estate Planning

Once you’re legally married, you should take time to add your spouse as your beneficiary on any life insurance, brokerage accounts, and

retirement accounts. A marriage is usually considered a qualifying life event, so you can add your spouse to your medical plan at work if you need to. You may also want to increase your

life insurance coverage so that your spouse isn’t left in the lurch with a mortgage and other expenses in the event of your untimely death.

Once you and your future spouse are on the same page about money and have developed a

financial game plan, consider

working with a financial advisor. A financial advisor or wealth management professional can help you reach your goals and understand your

estate planning options. Read more about

how to choose a wealth manager.

Start Your New Life Together with Quality Local Service from FNBT!

When it comes to how to talk about money in a marriage, there isn’t a one-size-fits-all formula. FNBT has been helping new families navigate money matters since 1882. We are a local community bank known for treating our customers like family. We are here to help your family succeed. Learn more about the ways FNBT can help you

prepare for your wedding day. Talk to a

local financial planner, open a joint

savings account or

checking account, or check out our retirement options. You can also visit any of our local offices in Beloit, Darien, Delavan, Argyle, Clinton, Elkhorn, Janesville, Monroe, Walworth, and Williams Bay, WI, or Rockton, Roscoe, and Winnebago, IL.