HSA: Two Great Reasons To Contribute Right Now

The Health Savings Account (HSA) is your best option for building healthcare savings. With its triple tax advantages, ability to roll funds over year after year, and easy access to your money when you need it, it’s no surprise there are now over 36 million (per

Devenir's June 2023 Survey) Americans leveraging the power of an HSA.

If you have an HSA and are eligible to contribute, now is the best time to maximize the benefits of increasing your balance. Here are two reasons why:

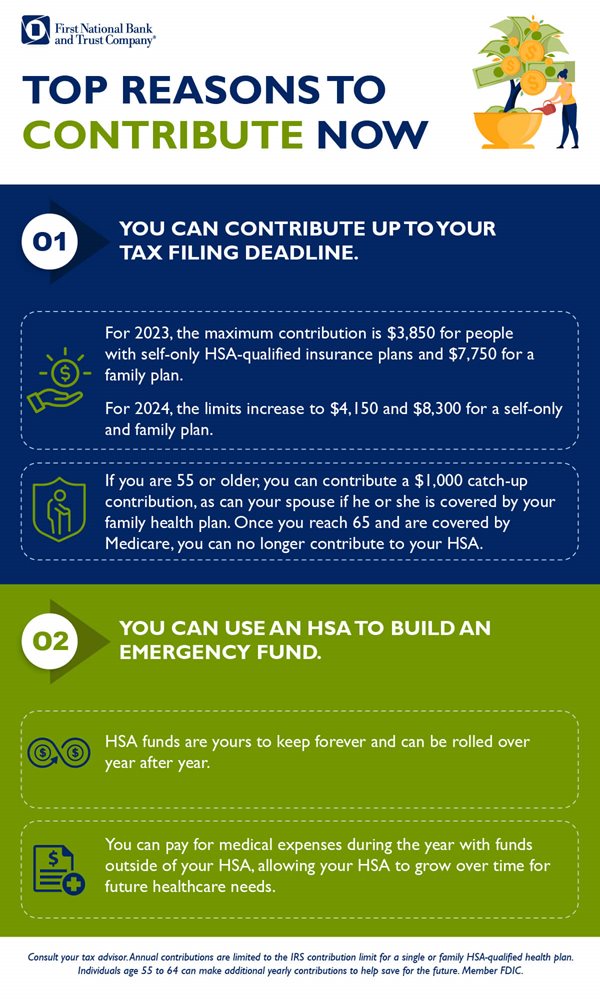

1. You can contribute for 2023 up until your tax filing deadline*

The IRS allows you to contribute for the previous year, similar to an Individual Retirement Account (IRA). For 2023, the maximum amount you can contribute is $3,850 for people with self-only HSA-qualified insurance plans (also referred to as High Deductible plans) and $7,750 for a family plan. Additionally, if you are 55 or older this year you can contribute a $1,000 catch-up contribution, as can your spouse if he or she is covered by your family health plan. However, please note, once you reach 65 and are covered by Medicare you can no longer contribute to your HSA but, you can continue to use any funds you’ve accumulated, tax-free, for qualified medical expenses.

So, check to see if you’ve maximized your HSA deposits for 2023 and if not, take advantage of the

tax savings you’ll receive by maxing out for last year. While you won’t receive the payroll/FICA tax deduction, you can still contribute and take the federal and state deductions (unless you live in NJ or CA) when you submit your 2023 tax return. Think of it as a “get to get” strategy whereby you save more money for healthcare expenses AND lower your 2023 tax bill.

2. Build an Emergency Fund

Unlike a Flexible Spending Account (FSA), with its “use it or lose it” rule, HSA funds are yours to keep forever and can be rolled over year after year. Think of an HSA as the “don’t use, won’t lose” account. While the biggest benefits of an HSA are its tax advantages and ability to save money for healthcare expenses in retirement, it serves another important purpose as an emergency fund. Here’s how:

Many HSA accountholders are now choosing to pay for medical expenses during the year with funds outside of their HSA. This allows the HSA to grow over time for future healthcare needs. If you choose this path and save receipts each time a medical expense occurs, you are accumulating funds for retirement, but you’re also giving yourself a cushion for any non-medical future expenses should they unexpectedly arise in a coming year.

For example, imagine you paid $1,000 of medical expenses in 2024 using a personal checking or savings account. And you elected to save this amount in your HSA in lieu of taking a distribution to cover those incurred medical expenses. In 2027 you decide to leave your job to pursue your lifelong dream of starting a business. We know starting a business is hard, and your income is more than likely lower than previous years, so when your vehicle needs some costly repairs, it can be difficult to pay those expenses from the income you’re drawing from the business. HSA to the rescue! Because you did not spend your HSA dollars in a previous year, the IRS allows you to take the $1,000 from your HSA to pay for the vehicle repairs without a penalty AND tax-free.

Whether you’re planning for retirement, looking to reduce your tax liability for last year, setting aside funds for a rainy day or all of the above, funding your HSA today is a smart move for you and your family. And First National Bank and Trust (FNBT) is here to help. FNBT offers

Health Savings Accounts to

businesses and

individuals in Southern Wisconsin and Northern Illinois. To set up an HSA,

contact us online or visit any of our

convenient locations in Beloit, Clinton, Darien, Delavan, Elkhorn, Janesville, Monroe, Walworth, Argyle, and Williams Bay, WI and Rockton, Roscoe, and Winnebago, IL.

Don't have a an HSA? Check out these

8 reasons to open a Health Savings Account.

*Consult your tax advisor. Annual contributions are limited to the IRS contribution limit for a single or family HSA-qualified health plan. Individuals age 55 to 64 can make additional yearly contributions to help save for the future.