How Much Savings Should I Have for My Age?

You know the old adage that money doesn’t grow on trees: We can’t just pluck a few bills off the branches and spend frivolously, knowing more cash will grow right back. For most of us, money is a limited resource that takes us effort to earn. Once we earn it, it can take us even more effort to save it. So if you’ve been seeking answers to the question, “How much money should I have saved?” the response depends heavily on how old you are and what you’re saving for.

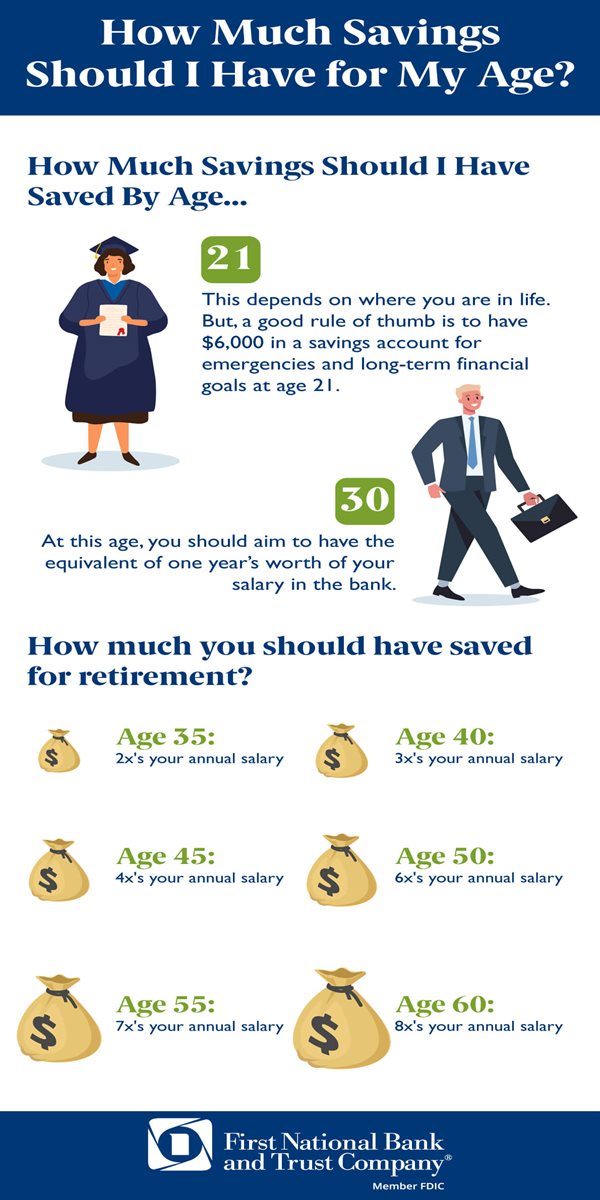

Are you asking, “How much money should I have saved by age 21 or age 30”? Or are you wondering how much money you should have saved for retirement?

We’ve got some guidelines to help you answer how much money you should have saved, along with answers to those other questions above — we’ve also sprinkled tips throughout this article on the best ways to save money each month, how to budget, and how to save money fast.

How much money you should have saved by 21?

The age of 21 is considered a seminal age in many people’s lives. They’re generally graduating from college, entering the workforce as full-time employees, and embarking on their careers. Yet even if you’re 21 and still in college, chances are you’ve at least had part-time jobs since your teens to earn pocket money. And retirement at 65 is still a mind-boggling 44 years away!

Either way, you haven’t hit your peak earning years, so you’re not earning a lot. However, a good rule of thumb for a 21-year-old is to have $6,000 in a savings account for emergencies and long-term financial goals. And that requires you to learn how to start

budgeting and saving money. If you’re nowhere near that amount, don’t panic. The best way to save money at age 21 is to start practicing the 50/30/20 rule: When you get paid, spend 50% for needs, 30% for wants, and 20% for savings or paying off debt. Once you’re disciplined enough, flip-flop the last two percentages and spend 30% on savings and debt and 20% on wants. And avoid what’s called lifestyle inflation, which is the tendency to increase our living standard whenever we start making more money. Read more about how to

adjust your budget to best fit your lifestyle.

How much money you should have saved by 30?

If you’re 30 and wondering how much you should have saved, experts say this is the age where you should have the equivalent of one year’s worth of your salary in the bank. So if you’re making $50,000, that’s the amount of money you should have saved by 30.

However, you may be paying off student loans or trying to save for a new car or your first house. So don’t despair: If you have half your salary saved, that’s still a good amount. What this does is shift the burden of increasing your savings to your later working years.

This is how you can smartly budget and save money each month at 30:

Avoid credit card debt — if you have a credit card, focus on paying off the balance each month. Carrying a balance means you’re paying interest on the amount you haven’t paid off, and that interest can be 18% or higher, depending on the card.

Pay yourself first — open a

personal savings account and set up direct deposit for your paycheck. Deposit 20% of every check into your savings account. And try not to touch that money. It can become your

emergency fund, and eventually, can serve as seed money as a down payment for your first home.

Find and open a high-yield savings account — let’s say you have $100 to start with, and you’re able to save $100 each month. If you open a high-interest savings account offering you a .06% interest rate, in one year you’ll have over $1,300 in that account. In five years you’ll have over $6,000.

Talk with a money manager — when it comes to investing their money, many people don’t know where to start. So seek out a

financial advisor who can help you create an investment strategy. A good financial advisor will work with you to understand your goals, create a financial plan, and regularly review progress with you.

How much you should have saved for retirement?

To determine how much you should have saved for retirement, you should think about how old you want to be when you retire and what you want your lifestyle to be like in retirement. Generally, financial experts suggest this is how much you should have

saved at each age, starting at age 35:

Age 35: 2 times your annual salary

Age 40: 3 times your annual salary

Age 45: 4 times your annual salary

Age 50: 6 times your annual salary

Age 55: 7 times your annual salary

Age 60: 8 times your annual salary

The earlier you start saving, the more you’ll have as you near retirement age.Regardless of your age, one of the best ways to save for retirement is to participate in your company’s 401(k) plan. A 401(k) allows you to invest automatically straight from your paycheck, so you may not even notice the money is being diverted to your retirement account. Many companies match some or all of your contribution to the 401(k), in effect giving you free money in exchange for saving for retirement.

Another popular option is opening an individual retirement account, or IRA. The big advantage of an IRA is that it provides you a tax break for saving, but it also offers other positives, too, such as tax-deferred growth on your contributions. The specific kind of benefits depend on the type of IRA.

Need help getting started?

Check out "How to Start Saving for Retirement".

Start saving at any age with First National Bank and Trust

Whether you’re just starting saving or you’ve been budgeting and saving for years, our experts at First National Bank and Trust can help you come up with financial strategies to meet any goal you have. From buying your first home to planning for retirement, we’re here to walk with you every step of your journey.

To get started,

contact us or visit one of our 16 locations.