An Escrow Account Disclosure is a review of your escrow account to ensure enough funds are collected to pay upcoming installments of your insurance premium(s) and/or property taxes.

How to Read Your Escrow Account Disclosure

Your Escrow Account Disclosure is designed to provide you with details about the review of your escrow account and the resulting changes to your monthly escrow payment.

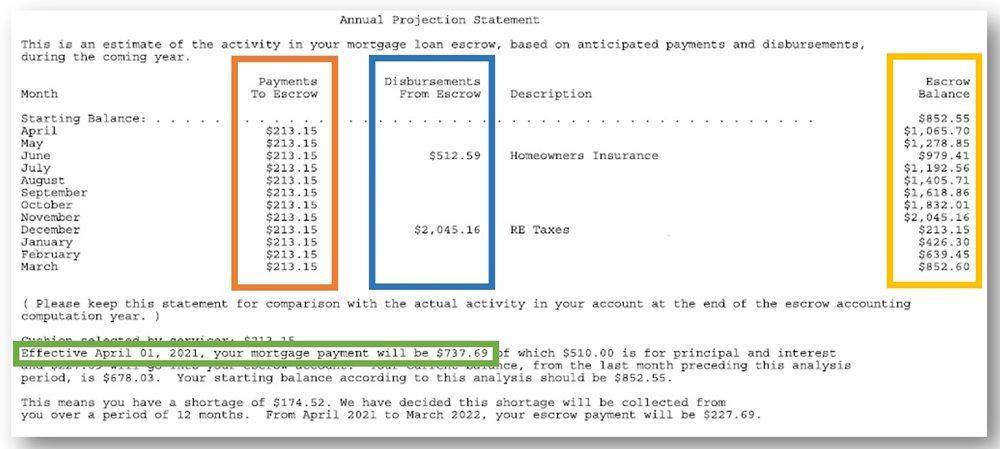

Annual Projection Statement (page 1)

This section of your Escrow Account Disclosure includes a table of information that shows the anticipated activity on your escrow account each month for the coming year. The table lists all of the expected transactions for your escrow account during the upcoming 12 months. The Starting Balance is the amount needed in the account by your next escrow period start date (April 1st in the example below) to ensure there are enough funds to cover expected property tax, insurance premium payments and meet the escrow reserve requirements.

Payments to Escrow:

This is the amount that goes into your escrow account each month.

Disbursements from Escrow:

This is projected amount that is expected to be paid out of your escrow account to pay for the anticipated property taxes and/or insurance premiums.

Escrow Balance:

This is the balance of your escrow account at the end of each month based on the projected payments and projected disbursements made during the month.

New Monthly Payment:

This is the amount of your new mortgage payment effective April 1, if you do not pay the shortage (if applicable).

Escrow Surplus:

If your escrow account shows a surplus, the actual taxes and/or insurance premium payment was less than anticipated for the previous 12 month period. If you have a surplus of $50 or more, a check will be mailed to you in 2-3 weeks.

Escrow Deficiency and/or Shortage:

If your escrow account shows a deficiency and/or a shortage, your statement will show that those amounts will be collected from you over the next 12 months, thereby increasing your monthly payment. You may choose to pay your escrow shortage in full by March 18, 2021 in the following ways:

- By Mail

- Mail your payment to 345 E Grand Ave, Beloit, WI and write your Loan Number and "Escrow Payment" in the memo field of the check.

- In Person

- By Phone

- Contact our Customer Support team by calling 800.667.4401 to make your payment over the phone.

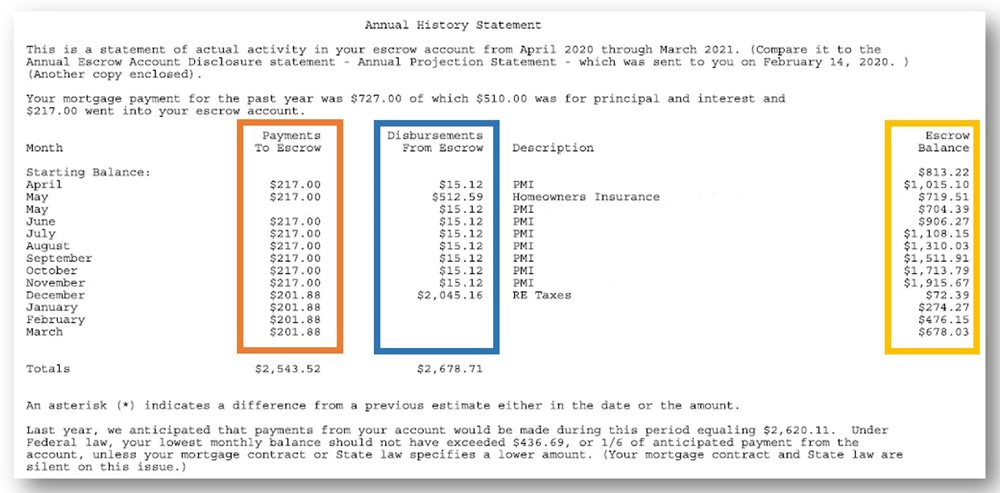

Annual History Statement (page 2)

This section of your Escrow Account Disclosure shows the actual activity in your escrow account for the previous 12 month period. It includes the escrow portion of your monthly payment that was deposited into your escrow account, funds that were paid out of your escrow account to pay for property taxes and insurance premiums, and the balance of your escrow account at the end of each month based on actual payments and actual disbursements made during the month.

Payments to Escrow:

The escrow portion of your monthly payment that was actually made and was deposited into your escrow account.

Disbursements from Escrow:

Funds that were actually paid out of your escrow account to pay for property taxes and insurance premiums.

Escrow Balance:

The balance in your escrow account at the end of each month based on the actual payments and actual disbursements made during the month.

Please Note: First National Bank and Trust does not control the actual amount of your tax and insurance bills. Please contact your insurance company or your local insurance agent if you have questions about changes to your premium. Please contact your local tax office if you have questions about your tax bill.

If you have questions regarding your statement, please contact our Customer Support Team at 800.667.4401.